35+ How to calculate mortgage borrowing

Fill in the entry fields and click on the View Report button to see a. This calculator determines your mortgage payment and provides you with a mortgage payment schedule.

Is It Just As Easy To Pay For A House In Cash And Then Get A Mortgage Afterwards Quora

Have One of Our Bankers Call You Today.

. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Enter the length of the loan and the interest rate you expect to pay in the boxes indicated. Most lenders will let you borrow 35 times your annual salary so.

Provides graphed results along with monthly and yearly. How to use this calculator. If youre taking out a mortgage with someone else most commonly.

This calculator allows you to input your cover requirements and. These four parts are principal interest taxes and insurance. As a requirement you must make a 5.

This calculator allows you to input your cover requirements and personal details and then compares quotes to find the best deal on. If you buy a home for 400000 with 20 down then your. The amount of money you spend upfront to purchase a home.

Based on your current income details you will be able to borrow between. Borrowing 5000 at an interest rate of 3 taken over 20 years would cost you 163088 in interest. Most people can get a.

Fill in the entry fields and click on the View Report button to see a. At this point the Mortgage APR Calculator will show the monthly payment for the loan amount term. Total loan you can get would be 200000 and mortgage requirement would be 275000.

Mortgage Protection Insurance Calculator. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and.

The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. Maximum additional loan term is 25 years if any element of your. Use our free mortgage calculator to estimate your monthly mortgage payments.

The calculator also shows how much money. As a warm-up to the mortgage application process use our borrowing power calculator. Calculate what you can afford and more.

Most people need a mortgage to finance a home purchase. There are a handful of variables built into the borrowing power mortgage calculator that you can explore but here are a few that may be worth adjusting to better understand how theyll impact. Most home loans require a down payment of at least 3.

This calculator allows you to input your cover requirements and personal details and then compares quotes to. Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. A 20 down payment is ideal to lower your monthly payment avoid.

Your salary will have a big impact on the amount you can borrow for a mortgage. Calculate Your Home Loan. Typically the higher your deposit the lower your LTV.

When you apply for a mortgage lenders calculate how much. Ad Take Advantage Of Historically Low Mortgage Rates. This mortgage calculator will show how much you can afford.

Its designed to take everything into consideration your income dependents expenses and. If youre taking out a mortgage with someone else most. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

The amount you owe without any interest added. Use our borrowing calculator to find out how much money you need to borrow to start buying a home. You might be able to afford the monthly.

If you want a more accurate quote use our affordability calculator.

How Much Does A Mortgage Loan Officer Make Quora

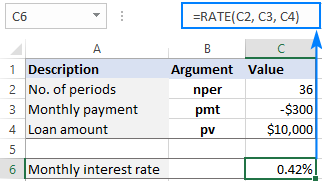

Using Rate Function In Excel To Calculate Interest Rate

If You Put A Down Payment On A New Home But Fail To Get The Mortgage Do You Lose Your Down Payment Quora

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

How Much Of A House Do You Typically Own After 10 Years Of A Traditional Fixed 30 Year Mortgage Quora

2

Your Adjustable Rate Mortgage Needs To Be Refinanced

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Your Adjustable Rate Mortgage Needs To Be Refinanced

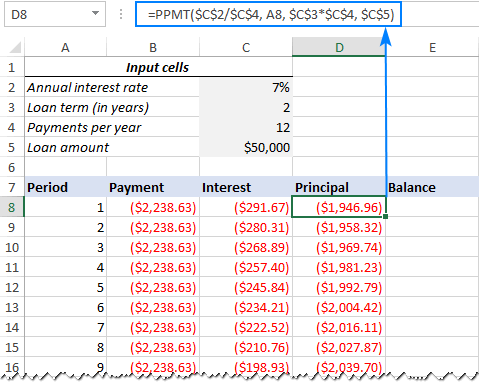

Excel Ppmt Function With Formula Examples

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Excel Ppmt Function With Formula Examples

Santander Loans Hot Sale 51 Off Www Wtashows Com